Follow these 9 investment rules and your assets will grow. Invest:

- simply,

- with no emotions,

- with low cost,

- passively,

- long-term and patiently,

- with a suitable portfolio,

- with distributed risk,

- tax smart,

- regularly.

Invest simply

Paradoxically, the simplest investment solutions are usually the most profitable. Do not unnecessarily complicate your investment strategy and do not invest in something you do not understand.

Legendary investor, billionaire and one of the planet´s wealthiest people Warren Buffett, was guided by a simple rule when choosing his investments: He only invested in businesses he understood and in companies with products of which he met on daily basis.

Moventum offers basic investment for everyone. We apply a simple investment strategy to all the largest and most successful companies in the world.

Avoid emotions

The biggest enemies of investments are investor emotions and so-called limitations of mind inherent in each human being. These include:

- Herd mentality - It is a tendency to adopt to the crowd. It is based on the assumption that the majority can not be wrong. However, as history shows, in finance we can observe one of the most dangerous precedent of behaviors (bubbles, sales, fear of wrong market timing, etc.).

- Too much self-confidence - People tend to think they are above average and that they can do things better than others. This is a dangerous notion in investing. To believe that I can manage to overcome the market when 99% of investors fail to do it, is very naive and financially painful.

- Distortion of facts - In general, we tend to choose those facts that confirm our theories and overlook the ones which rebut them.

- Fear of Loss - Numerous research has shown that the fear of loss is emotionally three times stronger than the enjoyment of profit. That's why many resort to the rapid sale of profitable securities and the holding of loss positions, which is the wrong investment behavior.

- Mental short-sightedness - We focus more on the current facts, things that have happened recently or that might happen in the near future. Our decisions are rather short-term, even impulsive. This affects the investment negatively. For example, as a result of the so-called. mental short-sightedness we tend to buy when market is on top and sell on the bottom.

Numerous behavioural finance studies have confirmed that the vast majority of individual investors achieve lower returns than the market due to the above-mentioned inherent behaviour patterns.

To be successful on the financial markets, you must not allow emotions to affect your investment. The solution is to limit your decisions and interventions to a minimum.

Moventum intelligent investing requires only basic decisions from you. You will determine your financial goals, the horizon of investing, reveal your propensity to risk, and the rest will be taken care of by us to your satisfaction - we will select the ideal portfolio fitting your needs and make it thrive during the whole investment period.

Low fees

Charges eat into your income from. The amount of the fees is crucial to the final result of the investment.

If you want to invest successfully, never overlook the fees. Lower fees mean higher returns for you

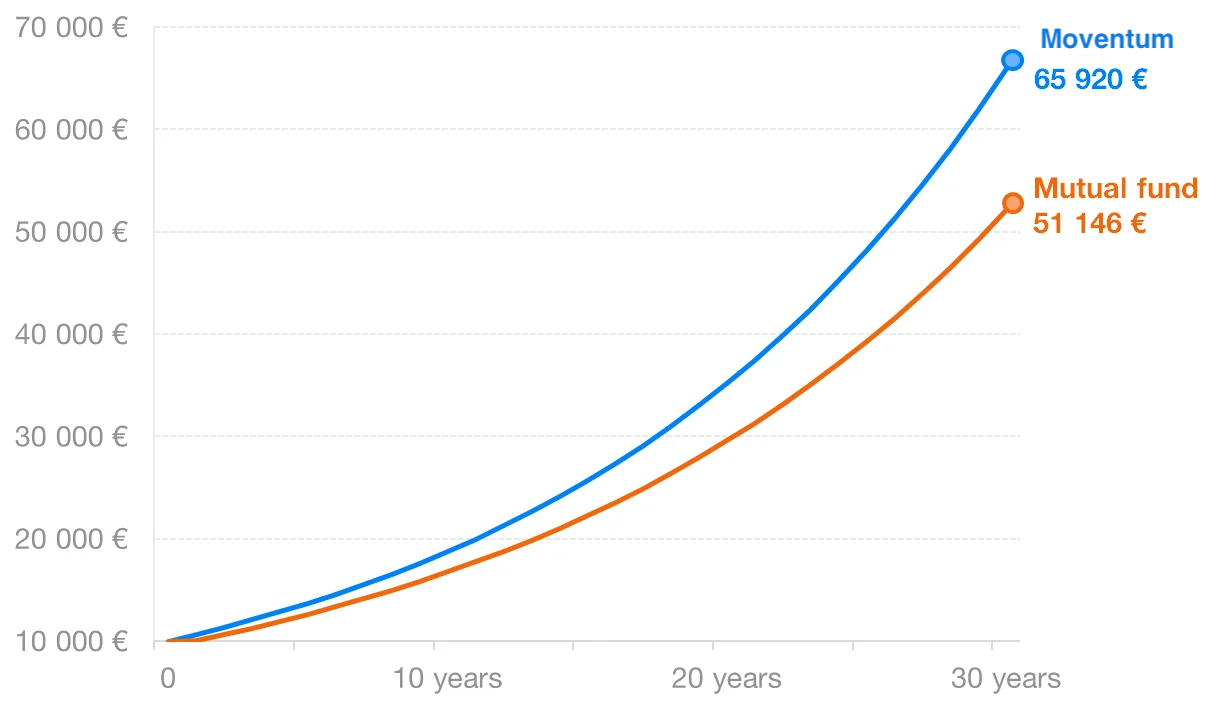

Take a look at the chart that shows the impact of fees on the

ultimate appreciation of an investment. It compares the impact of the fee structure of Moventum and the average European equity mutual fund on the return of an investment with an average appreciation of 8% per year.

Comparison of the cost of the underlying investment in Moventum and the average of the 10 largest equity mutual funds in Europe as of June 16, 2024(data source Fund Key Information Documents).

Do you see the difference? Moventum 's investment solutions are unrivaled in terms of fees. In Europe, you can hardly find another cost efficient alternative to a managed portfolio.

Passive investment in the market

Passive investment is the best fit for the implementation of the previous three successful investor policies in practice.

Passive investment literally means investing in the entire market, that is, copying it. The advantage of passive investment is minimal, practically no intervention in the portfolio. It is therefore a "buy and hold" strategy. The strategy does not try to time investments, or select specific securities.

Limiting human factor risk together with minimal costs predisposes passive investment to higher profits.

Boost your financial knowledge

Always interesting topics in our Moventum webinars

For more information on passive and active investment see The Passive investment section.

The easiest way to invest successfully is to accept market returns. There is a very low likelihood that you will get more profits from long-term investments by any other means.

Invest long-term and patiently

As the saying goes, "slow and steady wins the race." This applies in particular to finances.

The key to success in investing is to use the so-called compound interest. Thanks to it, the value of the investment accelerates its growth every year.

Financial markets fluctuate over time, but so far they have always had only one direction in the long run, and that is growing. The companies you invest in make each year billions of profits. This profit always goes into their value (share prices) regardless of the current market mood.

Speculation is short-sighted. No billionaire has become billionaire by speculating, but by investing. The natural return of financial markets is between 8% and 10% per year.

A logarithmic graph of the development of the SP500 index over the last 70 years. Average growth of 7,8% p.a., with reinvested dividends 11,34% p.a.

Successful investor invests in the long run and is not subject to moods while keeping its investment horizon. Short-term fluctuations in investment are not the reason for changing the strategy.

Proper allocation

For your satisfaction with your investment, you need to know your propensity for risk.

Asset allocation is a way to divide an investment into various types of assets. Each asset differs in its returns and the risk associated. Historically, the most powerful asset is stock, but its price varies more than bonds that offer lower but more stable returns.

Proper distribution of your investment determines your future return. It is the essential tool for passive investment.

There is no universal optimal allocation - it is individual for every single investment, for every single investor.

Invest like a pro

With low fees, no emotions and tax smart.

As a specialist in passive investing, Moventum assists and supports its clients with the selection of a suitable allocation. Based on their goals, risk profile, purpose and investment horizon, we choose an individualized portfolio tailored to each and every client.

In principle, we recommend the following strategies:

- In case you have a longer investment horizon, choose more stocks and fewer bonds.

- If you invest a greater portion of your savings, choose more bonds.

- If your risk acceptance is high, choose more stocks.

Diversifying or more precisely spreading the risk

While the allocation refers to the specific composition of the investment, diversification denotes its diversity. If you buy shares of 10 major oil companies, those will be your allocation, but the diversification of the portfolio will be low. Portfolio diversification is important from several aspects, especially in passive investing:

Reduces risk

You will surely know the old rule that we never put all the eggs in one basket. When the basket falls, we lose all the eggs. That is also what to do when investing. The more instruments in the portfolio, the portfolio risk is smaller, as the loss of one of them is negligible for the whole. Diversified portfolios are more stable.

Increases revenues

No one can certainly predict which asset will bring the highest profit and the biggest loss for the year. The winners or losers are from different asset class each year. Any effort to invest in winners only usually ends in a worse return than the market itself. Therefore, it is most reasonable to choose a broad mix of assets.

It is a condition of passive investment

Passive investment is talking about investing in to the market. The market consists of all securities traded on a particular stock exchange or in the region. In case you wish to invest to the whole market, you have to buy a portfolio composition of which is the same as the composition of the market, so it is also a wide diversified portfolio.

Sorted results of the 10 ETF index funds in euro-denominated statements that make up Moventum portfolios are being shown in the following matrix between 2004 and 2019. It clearly demonstrates that assets that are winners in one year often end at the end of the rankings over the next few years.

All portfolios managed by Moventum are broadly diversified. That's us Moventum who allow you to invest in different asset classes only starting from €10 transaction. With us, with one simple portfolio, you invest in over 10,000 securities.

Tax smart

To make your investment as profitable as possible, you need to optimise your tax as much as possible.

Different asset classes and different approach to investment has different tax regimes. There are different approaches to optimize tax on your investments.

It is important to set the investment strategy, so there is possibly zero or low tax consequences.

When creating portfolio strategies Moventum also emphasized the tax aspect of investments. By investing with us, you will not have to pay any unnecessary tax. Thus, bigger return will result in your assets growing faster.

Schedule a 15 minute phone call for free

We will help you get started and learn more about Moventum .

Invest regularly

If you do not have larger savings, do not despair. Invest regularly in smaller amounts.

Saving part of your income is ultimately easier from the point of view of your budget. It is easier to save in smaller amounts, e.g. 500 euros rather than waiting until you could make a bigger deposit. Another advantage is that your funds start to appreciate as soon as possible.

In addition, regular investment is also interesting in terms of risk. When buying securities every month, you do not have to worry about whether markets will fall shortly after investing. Fixed investment every month mitigates risk, as you buy more stocks when the markets are falling (as they are cheaper) and vice versa in the case of market growth you buy less (as those are more expensive).

Regular investment is a solution that allows everyone to invest.

Moventum makes investing available to everyone. Our mission is to bring Intelligent Investing into every household, so you can invest from € 10.